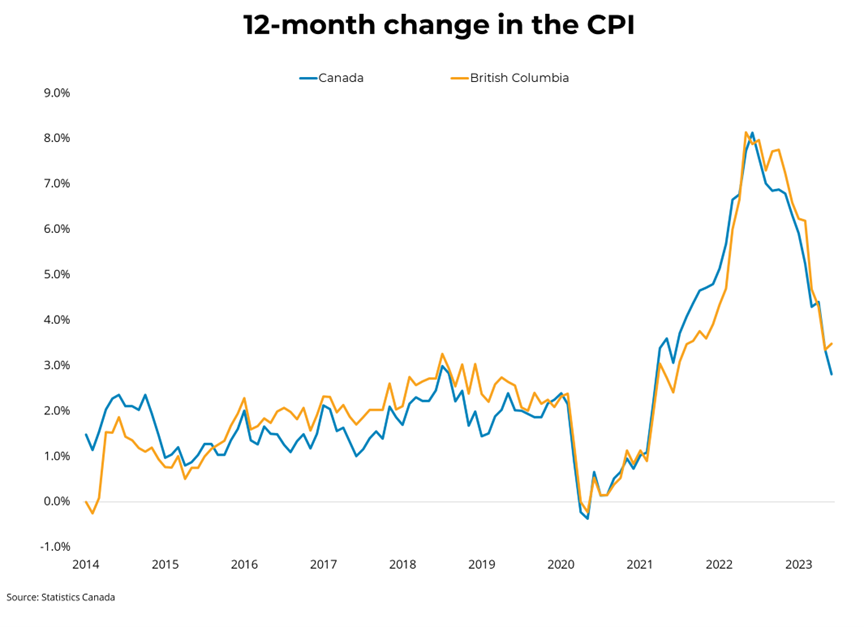

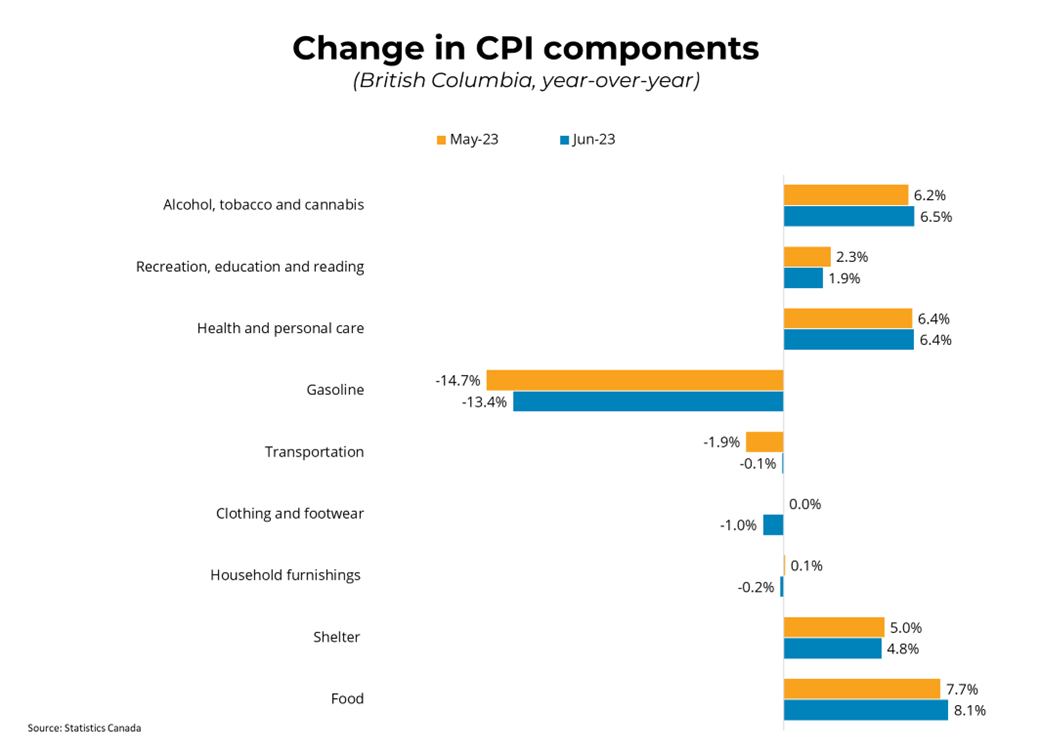

Canadian prices, as measured by the Consumer Price Index (CPI), rose 2.8 per cent on a year-over-year basis in June, down from 3.4 per cent in May. While declines occurred in several categories, the largest contribution was from lower gasoline prices compared to the same month last year (-21.6 per cent). Ignoring gasoline, year-over-year inflation would have been 4 per cent in June. Shelter costs were up 4.8 per cent year over year, driven by much higher mortgage interest costs (up 30.1 per cent from last year) along with higher rents (up 5.8 per cent from June 2022). The homeowner’s replacement cost, which tracks home prices, was down 0.7 per cent year over year. Grocery prices were up 9.1 per cent year over year. Month over month, CPI rose 0.1 per cent. In BC, consumer prices rose 3.5 per cent year-over-year.

The CPI continued to cool in June, with year-over-year prices rising at the slowest rate since March 2021, and now within the Bank of Canada’s target of 1 to 3 per cent. Much lower gasoline prices compared to the same time last year are doing much of this work, but recovering supply chains also contributed, with furniture and household appliances both on average cheaper than the same time last year. The Bank of Canada’s measures of core inflation, which strip out volatile components, are trending downwards and are now mostly below 4 per cent year-over-year. CPI is being pulled down by energy costs, household operations and furnishings, and clothing costs. In the other direction, food, shelter, and mortgage costs are dragging the CPI upwards. Taken together, that this month’s headline inflation figure is within the Bank’s 1 to 3 per cent target is excellent news and provides support for the Bank to ease off rate tightening going forward.

Link: https://mailchi.mp/bcrea/canadian-inflation-june-2023

Economics Now is produced by the British Columbia Real Estate Association. Real estate boards, real estate associations and REALTORS® may reprint this content, provided that credit is given to BCREA by including the following statement: “Copyright British Columbia Real Estate Association. Reprinted with permission.” BCREA makes no guarantees as to the accuracy or completeness of this information.

Additional economics information is available here on BCREA’s website.